2015 allows an individual or business entity to elect a party usually an accountant or tax attorney to file federal taxes on their behalf.

Power of attorney form florida for elderly parent.

One may be used to assign a health care surrogate to oversee an individual s end of life care while another may be used to provide a tax accountant with the authority to file a florida resident s state taxes.

How to get power of attorney for elderly parents.

A power of attorney document is a very helpful legal tool to manage the affairs of a family member with a serious progressive illness.

Even if you manage to coerce them into accepting your assistance that would be considered undue influence and a judge may invalidate the power of attorney.

A health care power of attorney or health care advance directive communicates the treatment wishes of your loved one in the face of a crisis.

Instead you ll need to petition the court for guardianship.

If you are not familiar with the power of attorney laws in florida you can always trust an elder law attorney tampa fl.

Here are 5 simple steps that you can follow to get power of attorney for your elderly parents with the assistance of elder lawyer tampa.

Each form serves a unique purpose.

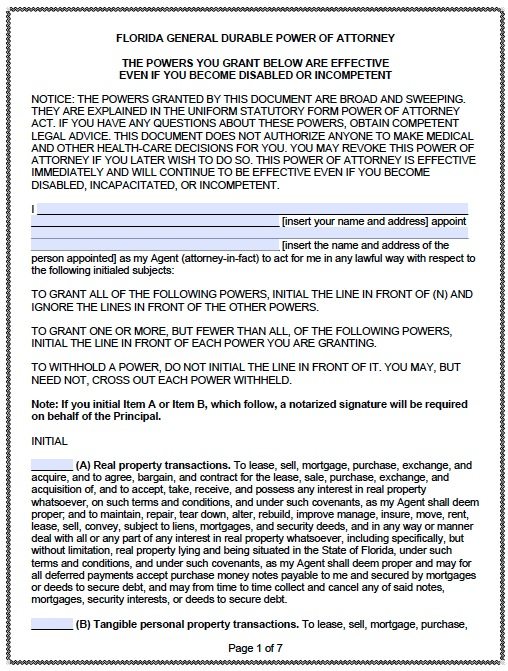

Florida power of attorney forms provides a way for a person to assign his or her legal authority over his or her financial and other matters to another person.

There are two kinds and ideally you should have both.

Power of attorney is a written authorization that lets you make decisions on behalf of your incapacitated loved ones.

It is not a simple form.

The durable power of attorney is a powerful and complicated legal instrument.

What rights does power of attorney give you.

Attempting to adapt generic forms found online and in office supply stores is unwise and a potentially costly mistake.

Elderly people usually choose to give one or more of their children power of attorney.

This allows the other person or agent to act on the person s or principal s behalf.

A lasting power of attorney is the best choice for your elderly loved one because it can be put in place far in advance of being needed while your relative is able to make their own decisions and decide who they would like to grant control to.

Florida power of attorney allows a resident to choose someone else an agent attorney in fact or surrogate to handle actions and decisions on their behalf.

If a parent with dementia or alzheimer s refuses assistance a power of attorney is not an option.